The Harris County Municipal Utility District No. 504 (HCMUD 504) Board of Directors would like to inform residents of the current ad valorem rate exemptions and remind residents regarding annual property taxes.

Many residents of Harris County Municipal Utility District No. 504 may not have realized the Board of Directors voted to implement an exemption on property taxes for residents who are over 65 years of age and/or disabled for the 2024 tax year. This exemption is $20,000 off the assessment value of the home, meaning residents who qualify for the exemption would pay property tax at a lowered assessed property amount than previous years.

This exemption was implemented to try to offset the impact of rising home values on the tax bills for those who may be on fixed or limited income within the District.

Every year, the District re-assesses its exemptions and votes to maintain or change them in the spring, and those exemptions are also considered when determining and setting the District’s current year tax rate for all residents in the fall.

How are my taxes calculated?

Property market value: Estimated worth or price at which a property can be bought or sold in the Texas real estate market.

Property appraised value: Assessed or estimated value or a property, as determined by a professional property appraiser or by the local county appraisal district.

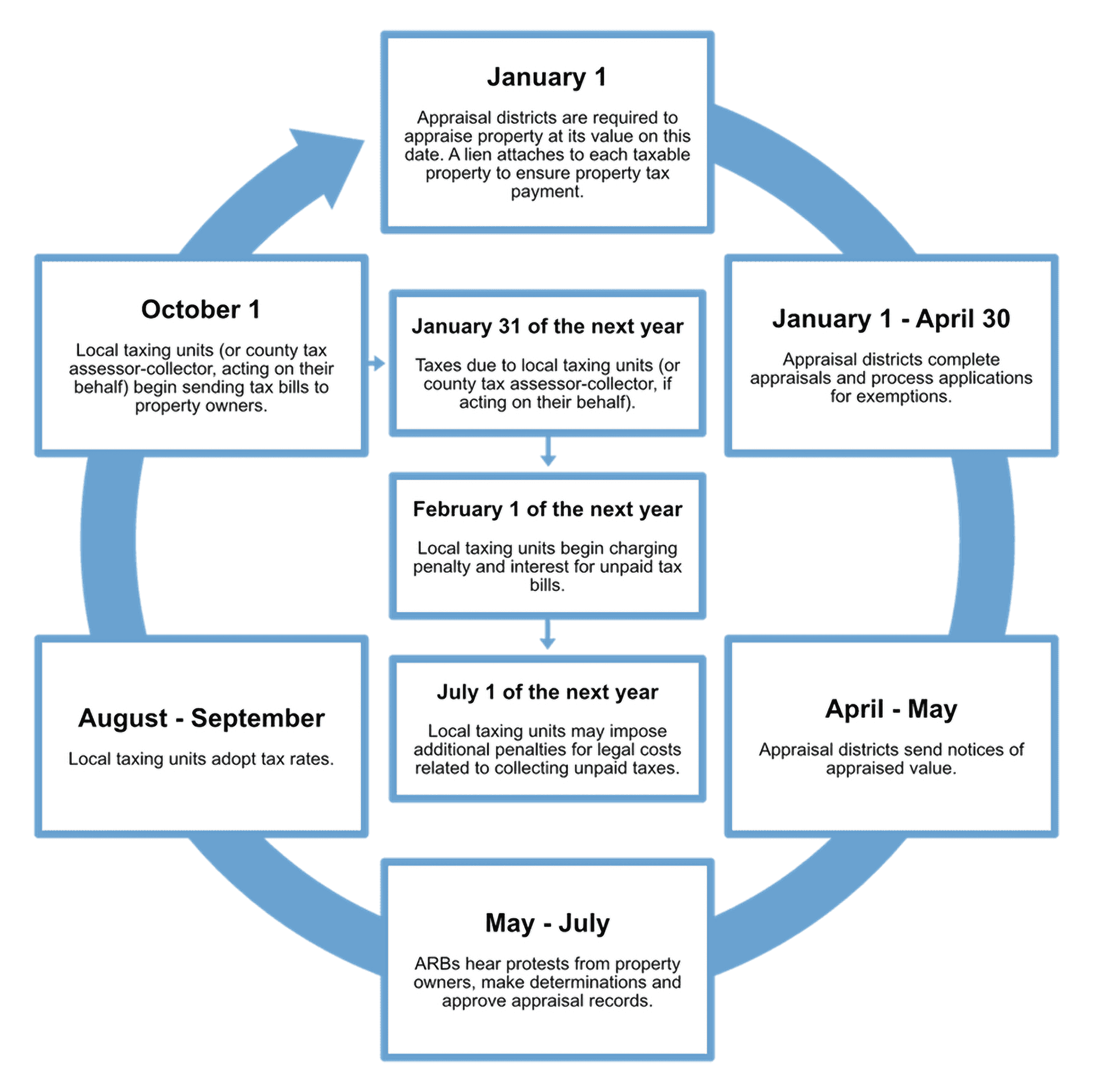

Your property's value is assessed each year on January 1 by the appraisal district and is used by the different taxing entities to calculate your tax bill. Once the values are certified by the county appraisal district, the Board of Directors sets the tax rate for HCMUD 504 based on input from their financial advisor. Your tax bill is calculated by multiplying your property’s appraised value by the tax rate. There are a few exemptions that may apply to you depending on the taxing entity, such as a general homestead exemption and the over-65/disabled exemption.

You can protest the value with the county appraisal district if you think it’s unfair or overvalued. Local entities set tax rates in the fall. You should expect to receive your property tax bill in the mail by the end of October/beginning of November. You have until January 31st of the following year to pay it without penalty.

Factors of Appraisal Price:

- Location of residence

- Condition of home

- Size of home

- Recent Sales of Similar Homes

Remember:

- Your property's value is assessed every January 1st

- You can protest your appraised value if you think it is too high or low

- Local entities set their own tax rates

- For the 2024 tax year, HCMUD 504 granted a $20,000 exemption on assessment for residents over 65 or disabled; there is no current general homestead exemption

- You have until the end of January to pay your property tax bill without penalty

Tax Bill Formula: (Home Appraised value – Exemptions) divided by 100. Then multiply the product by the tax rate = your bill. See video for example.

Watch this informational video produced by the Association of Water Board Directors (AWBD) to learn more.

.jpg)